Purpose

The purpose of this financial model is to illustrate the distinct accounting treatments and financial implications of IFRIC 12 Service Concession Arrangements, under both Financial Asset and Intangible Asset arrangements, compared to traditional Fixed Asset arrangements as outlined in IAS 16. This guide aims to enhance understanding of the differences in recognition, measurement, and presentation of assets under these scenarios, focusing on their impact on the Statement of Comprehensive Income and the Balance Sheet. It serves as a practical guide for finance professionals, auditors, and students.

Applicable Terms/Facts for All Arrangements

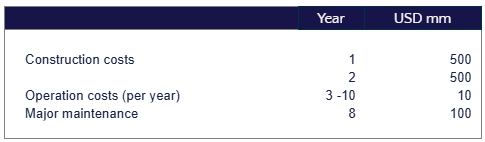

This section of the user guide provides an overview of the terms and assumptions applied across all arrangements within this model, facilitating a comparative analysis of Fixed Asset, Intangible Asset, and Financial Asset arrangements. To ensure consistency and clarity in illustrating the differences among these arrangements, the model employs uniform estimated costs and revenue figures, as detailed below:

Cost:

Revenue:

- USD 200 million per annum during years 3–10

Cash Flow Timing:

- For illustrative purposes, it is assumed that all cash flows occur at the end of each year.

Financing Assumptions:

- It is presumed that the operator fully finances the arrangement through debt and retained earnings, with an annual interest rate of 6.7% on outstanding debt.

Working Capital Assumptions:

- For illustrative purposes, it is assumed that there are no delays in payables or receivables (Payables and Receivables days are 0).

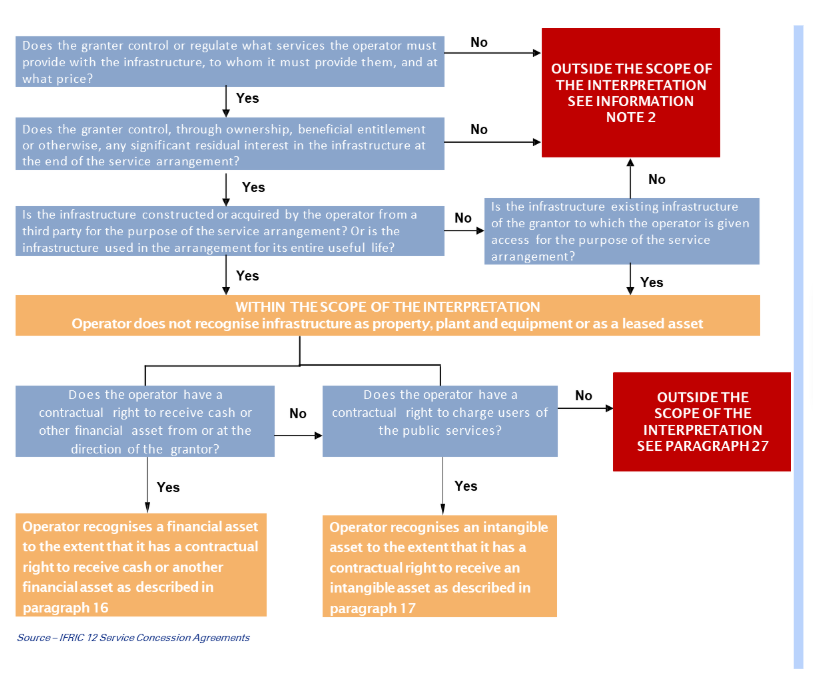

IFRIC 12 Flow Chart

IFRIC 12 – Intangible Asset

Arrangement facts

The terms of the arrangement require an operator to construct an infrastructure completing construction within two year and operate the infrastructure to a specified standard for eight years (ie years 3–10).

The terms of the arrangement also require the operator to perform major maintenance on the infrastructure when the original condition has deteriorated below a specified level. The operator estimates that this maintenance will be necessary at the end of year 8.

At the end of year 10, the service arrangement will end.

The terms of the arrangement allow the operator to collect fees from users of the infrastructure.

The operator forecasts that user numbers will remain constant over the duration of the contract and that it will receive fees of 200 USD mm in each of years 3–10.

Nature of the asset

Demand risk borne by the operator.

Operator receives the right to charge users using the infrastructure.

Asset ownership by the Grantor.

Residual interest at the end of the service arrangement to the Grantor.

Capital investment by the operator.

This type of arrangement is characterized as Service Concession Arrangements, BOT, intangible asset scenario within the framework of IFRIC 12.

Revenue

The operator is considered a service provider, offering construction or upgrade services during the construction phase and operational services during the operation phase.

The operator recognizes and measures revenue during both the construction phase and the operation phase in accordance with IFRS 15.

The operator provides construction services to the grantor in exchange for an intangible asset (the right to collect fees from the infrastructure users in years 3 to 10), measuring it at fair value based on stand-alone selling prices recognizing revenue and costs based on the construction’s stage of completion, as per IFRS 15.

In in each of the year 1 and 2 call it recognizes construction revenue of USDmm 525, construction cost of US mm500 and construction profit of USDmm 25 in its income statement.

Upon completion, the contract asset is reclassified as an intangible asset for the right to charge service users.

During the operational phase, users pay fees for the infrastructure as they use it. The operator recognizes fee revenue of USDmm 200 each of the years 3 to 8.

Borrowing cost

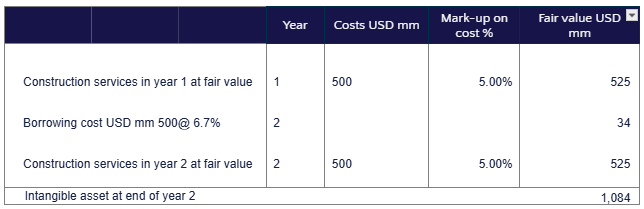

During the construction period, The operator capitalizes borrowing cost (estimated at 6.7% in this arrangement), under IAS 23 when it has a contractual right to receive an intangible asset.

Intangible asset

The operator recognizes the intangible asset in accordance with IAS 38.

Initially, the operator measures this intangible asset at cost, equivalent to the contract asset recognized during the construction phase.

The operator subsequently measures the intangible at cost less accumulated amortization and impairment losses. The asset’s useful life is the concession’s term, with amortization starting when the asset is available for use, i.e., when the operator can exercises its rights to charge users under the concession.

Selected Journal Entries

| Construction phase – year 1 | |||||||||||

| Revenue on construction services | |||||||||||

| Dr. | Contract asset | 525 | |||||||||

| Cr. | Construction revenue | 525 | |||||||||

| Capitalization of borrowing costs | |||||||||||

| Dr. | Contract asset | 34 | |||||||||

| Cr. | Interest expenses | 34 | |||||||||

| Construction phase – year 2 | |||||||||||

| Revenue on construction services | |||||||||||

| Dr. | Contract asset | 525 | |||||||||

| Cr. | Construction revenue | 525 | |||||||||

| Upon completion, the contract asset is reclassified as an intangible asset | |||||||||||

| Dr. | Intangible asset | 1,084 | |||||||||

| Cr. | Contract asset | 1,084 | |||||||||

| Operating phase – year 3 | |||||||||||

| Revenue | |||||||||||

| Dr. | Cash | 200 | |||||||||

| Cr. | Revenue | 200 | |||||||||

| Intangible asset amortization | |||||||||||

| Dr. | Amortization expense | 135 | |||||||||

| Cr. | Intangible asset | 135 | |||||||||

IFRIC 12 – Financial Asset

Arrangement facts

- The terms of the arrangement require an operator to construct an infrastructure completing construction within two year and operate the infrastructure to a specified standard for eight years (ie years 3–10).

- The terms of the arrangement also require the operator to perform major maintenance on the infrastructure at the end of year 8, the major maintenance activity is revenue-generating.

- At the end of year 10, the arrangement will end.

- The terms of the arrangement require the grantor to pay the operator 200 USD mm per year in years 3–10 for making the infrastructure available to the public.

Nature of the asset

- The operator bears NO demand risk.

- Unconditional contractual right to receive cash from the Grantor.

- Asset ownership by the Grantor.

- Residual interest at the end of the service arrangement to the Grantor.

- Capital investment by the operator.

This type of arrangement is characterized as Service Concession Arrangements, BOT, financial asset scenario within the framework of IFRIC 12.

Revenue

- The operator is considered a service provider, offering construction or upgrade services during the construction phase and operational services during the operation phase.

- The operator recognizes and measures revenue during both the construction phase and the operation phase in accordance with IFRS 15.

- In each of years 1 and 2, it recognizes construction revenue of USDmm 525, construction cost of US mm 500 and construction profit of USDmm 25 in its income statement.

- The arrangement has a significant financing component due to deferred payment for construction services. The operator receives cash for the construction services from years 3 to 10. The difference between the transaction price allocated to construction in years 1 and 2, and cash allocated to construction in years 3 to 10, is recognized as finance income using an effective interest rate of 6.18%.

- Upon completion, the amounts due from the grantor are accounted for in accordance with IFRS 9 as receivables.

- The costs are adjusted for an estimated profit margin to arrive at contract revenue which is the fair value of the consideration receivable from the Grantor.

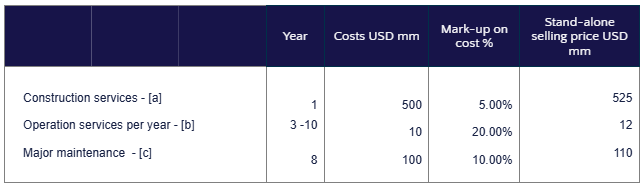

[a] The operator estimates the relative stand–alone selling price for the construction by reference to the forecast cost plus 5%.

[b] The operator estimates the relative stand–alone selling price for the operation services by reference to the forecast cost plus 20%.

[c] The operator estimates the relative stand–alone selling price for the major maintenance services by reference to the forecast cost plus 10%.

- The total consideration (USD200mm in each of years 3–8) is allocated to the performance obligations based on the

relative stand–alone selling prices of the construction services, operating services and major maintenance, taking

into the significant financing component.

Borrowing costs:

Under IAS 23, the borrowing costs are expensed in the period that they are incurred if the operator has a right to a financial asset.

Interest income on financial asset:

The model applies an effective interest rate calculation method to determine the interest rate applicable to financial assets.

This calculation involves discounting the cash flows, which include the fair value of services provided and receipts from the Grantor throughout the Concession Agreement period, over the entire concession period.

Financial asset

The operator recognizes the financial asset in accordance with IFRS 9.

Under IFRS 9, the financial asset to be subsequently measured at:

2.1 Amortized Cost, or

2.2 Fair Value through other comprehensive income (FVTOCI), or

2.3 Fair Value through profit or loss (FVTPL)

on the basis of the entity’s business model for managing the financial assets and the contractual cash flow.

Selected Journal Entries

| Construction phase – year 1 | ||||

| Revenue on construction services | ||||

| Dr. | Contract asset | 525 | ||

| Cr. | Construction revenue | 525 | ||

| Construction phase – year 2 | ||||

| Revenue on construction services | ||||

| Dr. | Contract asset | 525 | ||

| Cr. | Construction revenue | 525 | ||

| Borrowing costs | ||||

| Dr. | Interest expenses | 34 | ||

| Cr. | Cash | 34 | ||

| Upon completion, the contract asset is reclassified as an financial asset | ||||

| Dr. | Financial asset | 1,082 | ||

| Cr. | Contract asset | 1,082 | ||

| Operating phase – year | 3 | |||

| Revenue | ||||

| Dr. | Cash | 200 | ||

| Cr. | Revenue from operation services | 12 | ||

| Cr. | Finance income | 67 | ||

| Cr. | Financial asset | 121 | ||

| Costs | ||||

| Dr. | Operating services costs | 10 | ||

| Cr. | Cash | 10 | ||

Fixed Asset

Arrangement facts

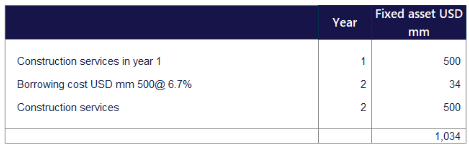

The terms of the arrangement require an owner to construct an infrastructure completing construction within two years and operate the infrastructure to a specified standard for eight years (i.e., years 3–10).

The terms of the arrangement also require the Owner to perform major maintenance on the infrastructure when the original condition has deteriorated below a specified level. The owner estimates that this maintenance will be necessary at the end of year 8.

The terms of the arrangement allow the owner to collect fees from users of the infrastructure.

The owner forecasts that revenue will remain constant over the duration of the contract and that it will receive fees of USD 200mm in each of years 3-10.The owner has control over the infrastructure and can operate it beyond year 10; however, for illustrative purposes, the arrangement is considered for 10 years to allow for comparison with other IFRIC 12 arrangements in this model.

Nature of the asset

Demand risk borne by the Owner.

Asset ownership by the Owner.

Residual interest at the end to the Owner.

Capital investment by the Owner.

This type of arrangement is characterized as a Build-Own-Operate, BOO, scenario within the framework of IAS 16.

Revenue

During the construction phase, revenue recognition does not apply as the project is not yet operational. Instead, costs incurred are capitalized as part of the infrastructure asset under construction.

During the operational phase, the owner records fee revenue from the users of USDmm 200 in each of years 3-10 in the income statement.

Fixed asset

The operator recognizes the financial asset in accordance with IAS 16

IAS 16 allows two methods for measuring assets after initial recognition:

2.1 Cost model: The asset is carried at its cost less depreciation and any accumulated impairment loss.

2.2 Revaluation model: The asset is carried at a revalued amount, being its fair value at the date of the revaluation less any subsequent accumulated depreciation and impairment losses.

| Selected journal entries | ||||

| Construction phase – year 1 | ||||

| Construction in Progress | ||||

| Dr. | Construction in Progress | 500 | ||

| Cr. | Cash | 500 | ||

| Capitalization of borrowing costs | ||||

| Dr. | Construction in Progress | 34 | ||

| Cr. | Interest expenses | 34 | ||

| Construction phase – year 2 | ||||

| Construction in Progress | ||||

| Dr. | Construction in Progress | 500 | ||

| Cr. | Cash | 500 | ||

| Upon completion, the Construction in Progress is reclassified as an fixed asset | ||||

| Dr. | Fixed asset | 1,034 | ||

| Cr. | Construction in Progress | 1,034 | ||

| Operating phase – year | 3 | |||

| Revenue | ||||

| Dr. | Cash | 200 | ||

| Cr. | Revenue | 200 | ||

| Intangible asset amortization | ||||

| Dr. | Depreciation expense | 129 | ||

| Cr. | Fixed asset | 129 | ||