Introduction:

Project finance is a specialized financing technique used to fund large-scale, capital-intensive projects such as power plants, water desalination facilities, real estate developments, and transportation infrastructure. It is a long-term financing approach that relies on the project’s cash flows as the primary source of repayment, rather than the project sponsors’ corporate balance sheets. This article will provide a detailed overview of project finance, its structure, phases, and how it differs from traditional corporate finance.

What is Project Finance?

Project finance involves the creation of a Special Purpose Company (SPC) or Special Purpose Vehicle (SPV), which is a legally separate entity formed specifically to design, build, and operate a particular project. The SPC is the borrower, and the project’s assets and cash flows serve as collateral for the lenders. Key characteristics of project finance include:

- Long-term financing: Project finance deals typically have a duration ranging from 7 to 40 years, with financing tenors spanning 5 to 25 years.

- High leverage: Debt financing can range from 60% to 80% of the total project cost, resulting in a high leverage ratio.

- Non-recourse or limited recourse financing: Lenders have a limited claim on the project’s assets and cash flows, with minimal or no recourse to the sponsors’ other assets.

- Large-scale projects: Project finance is typically used for large-scale projects that require substantial debt and equity financing.

Corporate Finance vs. Project Finance

While corporate finance focuses on financing a company’s operations and multiple projects, project finance is dedicated to a single, large-scale project. The key differences between the two include:

- Project finance concentrates on the financial, legal, and technical due diligence of the specific project, while corporate finance evaluates the overall financial strength of the company.

- Project finance equity is issued with a finite time horizon, whereas corporate finance equity has an indefinite time horizon.

- Project finance structures are complex and tailored to the project, while corporate finance structures are relatively simpler and more standardized.

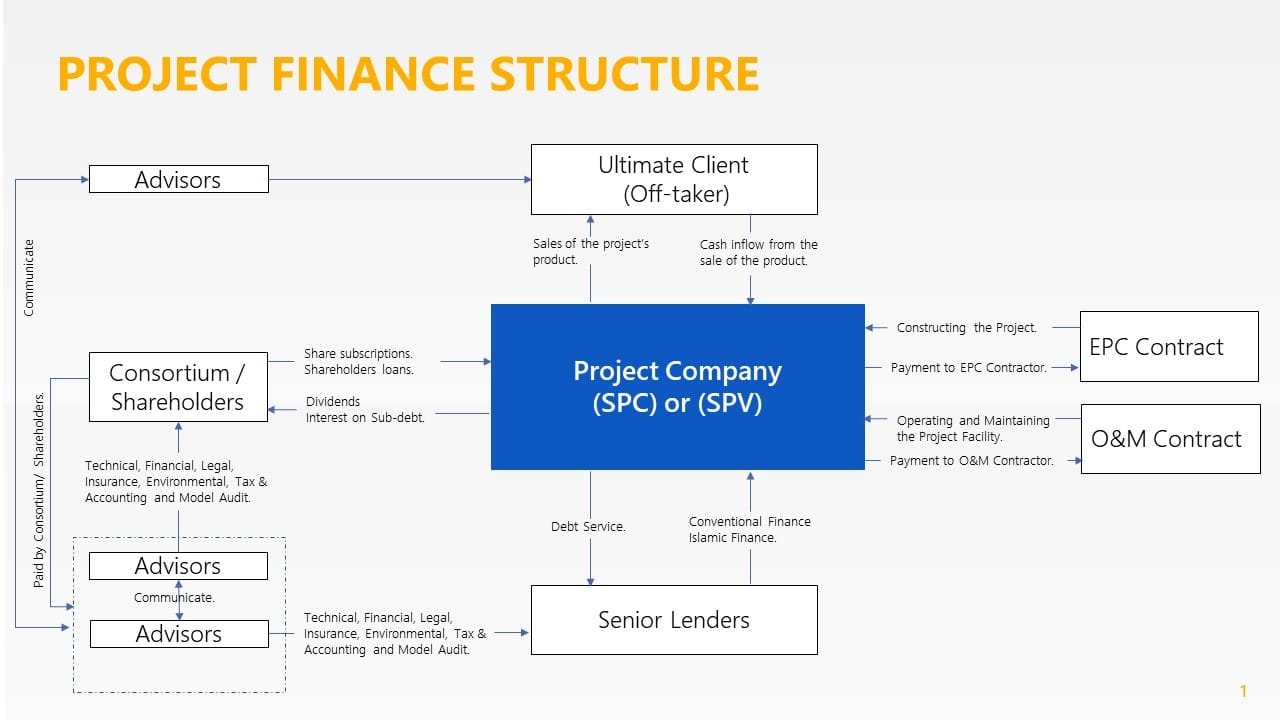

Project Finance Structure

The project finance structure involves various stakeholders, including the project company (SPC/SPV), sponsors/shareholders, senior lenders, contractors (EPC and O&M), off-takers (ultimate clients), and advisors. The key components of the structure are:

- Project Company (SPC/SPV): The borrower entity responsible for the project’s development, construction, and operation.

- Sponsors/Shareholders: Entities that provide equity capital and subordinated debt to the project company.

- Senior Lenders: Financial institutions that provide debt financing, typically secured by the project’s assets and cash flows.

- Contractors: Engineering, Procurement, and Construction (EPC) contractors and Operation and Maintenance (O&M) contractors responsible for project construction and operation, respectively.

- Off-takers: Entities that purchase the project’s products or services, generating the cash inflows for debt servicing and equity returns.

- Advisors: Technical, financial, legal, insurance, environmental, tax, accounting, and model audit advisors who provide expert guidance throughout the project’s lifecycle.

Project Finance Phases

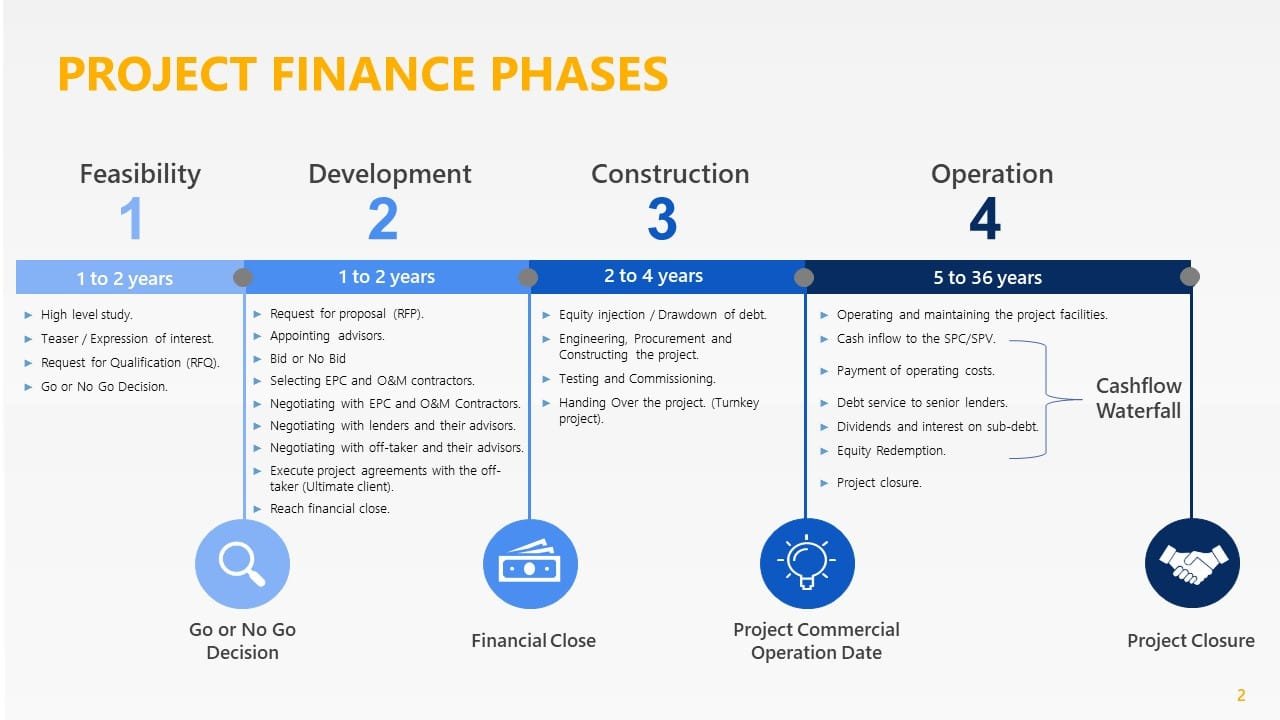

Project finance deals typically go through four distinct phases:

- Feasibility: This phase involves conducting high-level studies, requesting proposals, appointing advisors, evaluating bids, negotiating with contractors, lenders, and off-takers, and executing project agreements. It culminates in reaching financial close.

- Development: During this phase, equity is injected, debt is drawn down, and the project’s engineering, procurement, and construction activities take place, leading to testing, commissioning, and handover.

- Construction: This phase involves the actual construction and commissioning of the project facilities, as well as the transition to commercial operations.

- Operation: Once operational, the project generates cash inflows from the sale of its products or services. These cash flows are used to pay operating costs, service debt, distribute dividends and interest on subordinated debt, and ultimately redeem equity before project closure.

Conclusion

Project finance is a specialized financing technique that has become increasingly important for funding large-scale infrastructure and industrial projects worldwide. Its unique structure, involving a dedicated project company, multiple stakeholders, and a complex web of contracts, allows for the efficient allocation of risks and rewards among participants. By leveraging the project’s cash flows as the primary source of repayment, project finance enables the development of vital projects that might otherwise be challenging to finance through traditional means.